Red light therapy (RLT), also known as low-level laser therapy (LLLT) or photobiomodulation, has gained significant popularity in the U.S. as a non-invasive treatment for skin rejuvenation, pain relief, and muscle recovery. The market has expanded rapidly due to increasing consumer awareness, technological advancements, and endorsements from healthcare professionals. This article explores the current state of red light therapy in the U.S., analyzing key market drivers, major players, consumer trends, and future growth prospects.

Introduction

Red light therapy uses specific wavelengths of red and near-infrared light to stimulate cellular repair, reduce inflammation, and enhance collagen production. Originally developed for medical applications, RLT has transitioned into wellness and cosmetic industries, with devices now available for both professional and at-home use. The U.S. market has seen exponential growth, driven by rising demand for non-invasive aesthetic treatments and natural pain management solutions.

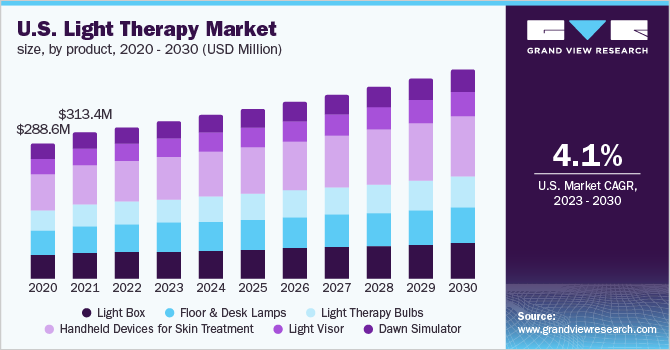

Market Overview

The U.S. red light therapy market was valued at over $500 million in 2023 and is projected to grow at a CAGR of 10-15% through 2030. Key factors contributing to this growth include:

- Increasing Demand for Non-Invasive Cosmetic Treatments

- Consumers are shifting away from surgical procedures in favor of safer, non-invasive alternatives.

- RLT is widely used for anti-aging, acne treatment, and scar reduction.

- Celebrities and influencers have boosted its popularity through social media endorsements.

- Rising Adoption in Pain Management & Sports Medicine

- Athletes and physical therapy clinics use RLT for faster muscle recovery and joint pain relief.

- Studies support its efficacy in reducing chronic pain, arthritis, and inflammation.

- Technological Advancements & At-Home Devices

- Companies like Joovv, Therabody, and Mito Red Light offer FDA-cleared devices for personal use.

- Portable and wearable RLT devices have made treatments more accessible.

Key Players & Competitive Landscape

The U.S. market features a mix of established medical device companies and emerging wellness brands:

- Joovv – A leading brand offering full-body RLT panels for home and professional use.

- Therabody (formerly Theragun) – Expanded into RLT with the Theragun LED Attachment.

- Mito Red Light – Known for affordable yet high-quality red light therapy panels.

- Deka Medical (Laser Aesthetics) – Provides clinical-grade RLT devices for dermatologists.

Competition is intensifying as more startups enter the market, focusing on affordability and smart features (e.g., app-controlled devices).

Consumer Trends & Challenges

- Wellness & Self-Care Boom – Post-pandemic, consumers prioritize at-home health solutions.

- E-commerce Growth – Amazon, Shopify, and direct-to-consumer (DTC) sales dominate distribution.

- Regulatory & Quality Concerns – The FDA does not regulate all RLT devices, leading to variability in product effectiveness.

Future Outlook

The U.S. red light therapy market is expected to grow further due to:

- Expansion into new applications (e.g., hair regrowth, mental health, wound healing).

- Integration with wearable tech (e.g., RLT masks with smart sensors).

- Increased insurance coverage for pain management and physical therapy applications.

Conclusion

Red light therapy has evolved from a niche medical treatment to a mainstream wellness solution in the U.S. With strong market demand, technological innovation, and growing clinical validation, RLT is poised for sustained growth. However, industry standards and consumer education will be crucial to ensuring long-term success.